boulder co sales tax efile

Sales and Use Tax 2011 -. Registration begins at 730 AM.

Colorado Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

A list of properties advertised for sale.

. EFT is due the 20th day of month following reporting period. 428 Year and Month. Our tax lien sale will be held Wednesday November 16 2022.

County road and transit improvements. Complete a Business License. Jail improvements and operation.

This is the total of state county and city sales tax rates. There are a few ways to e-file sales tax returns. With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular.

What is the sales tax rate in Boulder Colorado. How to Apply for a Sales and Use Tax License. 720 Title print only.

Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. Real Property Tax Lien Sale. 2055 lower than the maximum sales tax in CO The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11.

To start the blank utilize the Fill camp. This is the total of state and county sales tax rates. Boulder County Sales Taxes.

What is the sales tax rate in Boulder County. Please contact us if you have any questions or need clarification on any issue. Sales Use Tax.

The current total local sales tax rate in Boulder County CO is 4985. Sales and Use Tax 2002 - Ordinance No. Sale begins at 830 AM.

The minimum combined 2022 sales tax rate for Boulder Colorado is. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. Historic Preservation Tax 2009 - Ordinance No.

CO Sales Tax Rate. Boulder County CO Sales Tax Rate. Some cities and local.

Return the completed form in. Sign Online button or tick the preview image of the document. In addition to the information found on this website the City hosts seminars for tax instruction.

The minimum combined 2022 sales tax rate for Boulder County Colorado is. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

The Boulder County Sales Tax is 0985. Businesses that pay more than 75000 per year in state sales tax must pay by Electronic Funds Transfer EFT. E-File Your Tax Return Online - Here.

The December 2020 total. Non-profit human service agencies. The COVID-19 pandemic resulted in significant.

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. 10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. Tips on how to fill out the City of boulder sales tax returns on the web.

The city use tax rate is the same as the sales tax rate. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. The current total local sales tax rate in Boulder County CO is 4985.

What Are The Colorado Economic Nexus Sales Tax Details Sovos

Landowners Suing Boulder County Over Proposed Composting Facility At Site Of Former Nursery The Longmont Leader

Vote Guide 2021 Boulder Weekly

Wayfair Sues Lakewood Colorado Over Home Rule Sales Tax Complexity Taxvalet

Slow Tax Refunds Blamed For Taking Bite Out Of Restaurant Sales The Denver Post

Here S How Much Coloradans Can Expect From Largest Taxpayer Refunds In 20 Years

Sales Use Tax Foundations Part 9 Refunds And Credits Wolters Kluwer

How To File And Pay Sales Tax In Colorado Taxvalet

Managing Remotely Boulder County Firms See Challenges For Hr Accounting While Allowing Remote Work

File Sales Tax Online Department Of Revenue Taxation

Boulder County Assessor S Office Data Shows Persistent Discrepancy Between Projected Sales Prices Taxed Values On Expensive Homes

Boulder County Colorado Ballot Measures Ballotpedia

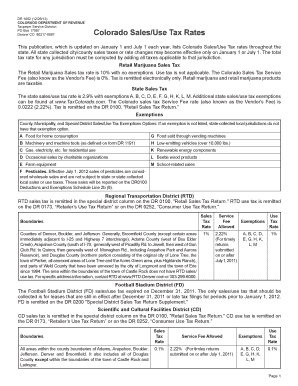

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

How To File And Pay Sales Tax In Colorado Taxvalet