uber eats tax calculator australia

Complimentary Upgrade Enrollment Offer TCs. 5-10 minutes What you need to know about tax as a food delivery driver.

Uber Driver Tax Deductions For 2022 All Your Questions Answered Wealthvisory

Uber Technologies NYSEUBER reported Q1 2022 results on May 4 dramatically underperforming earnings expectations.

. Using our Uber driver tax calculator is easy. The provincial tax rate is 5. All you need is the following information.

UberEATS remains the market leader and is now used by 128 of Australians including over 1-in-5 of both Generation Z and Millennials. We are taxed as small business owners. A common question for Uber and Uber Eats drivers is whether car loan repayments interest or car hire costs are therefore tax-deductible.

What Uber Eats paid you and what they say they paid you are two different numbers. Everyones tax situation is unique to them and unfortunately Uber isnt able to provide tax advice or answer questions specific to your individual tax requirements. Uber Eats Taxes are based on profits.

Order food online or in. This includes revenue you make on Uber rides Uber Eats and any other sources of business income. If you deliver for only Uber Eats you do not have to register or pay GST unless your turnover is more than 75000 a year.

From a tax perspective this can make your taxes tricky. How many Australians use UberEATS. UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income.

You simply take out 153 percent of your income and pay it towards this tax. Behind the bench with Aeroplan. This has led to the increase of food delivery companies like Deliveroo Menulog and UberEats.

With people becoming busier by the day ordering food has become the norm. Driving for Uber Eats only. Average Uber Delivery Driver hourly pay in Australia is approximately 2724 which meets the national average.

Other leading meal delivery services such as Menulog Deliveroo and. Get contactless delivery for restaurant takeaway groceries and more. The 124 percent of this tax is for Social Security and the rest 29 percent is for Medicare.

Regardless of whether the driver earns at least 100000 in revenue per year or if it is deemed to be a small supplier by CRA a driver can still get a license. Click on Tax Summary. Your average number of rides per hour.

This article is not meant to completely explain taxes for Uber Eats drivers. Your car expenses can reduce your taxable income by thousands. The self-employment tax is very easy to calculate.

Your total earnings gross fares Potential business expenses service fee booking fee mileage etc Remember that the information provided is designed to assist. If you drive for Uber and Uber Eats you will need to be registered for GST and pay GST on both your rides with Uber and food delivieries. This calculator is created to help uber drivers to estimate their gst and tax consequenses.

A The total amount received after the Service Fee is deducted. Select the relevant statement. In Australia and the US Uber drivers keep just less than 75 of their weekly fare total.

Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. The local tax rate in Ontario is 13. Your annual Tax Summary should be available around mid-July.

However much of this is similar for other gigs like. This Uber Eats tax calculator focuses on Uber Eats earnings. Every UBER driver must register with the Canada Revenue Agency and provide the agency with an HSTGST number.

Anyone who is a food delivery driver Tax Difficulty. Enjoy Uber VIP status and up to 200 in Uber savings on rides or eats orders in the US annually. If you deliver for UberEats and drive for Uber or split your time between ridesharing and food-delivery driving you will need to register for GST.

Find the best restaurants that deliver. The food industry has become very lucrative in Australia. For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes.

If you want to get extra fancy you can use advanced filters which will allow you to input. A common question for Uber and Uber Eats drivers is whether car loan repayments interest or car hire costs are therefore tax-deductible. Within the gig economy its common for people to work as both ride sourcing drivers and food delivery riders.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. Your tax advisor or yourself may like to speak to Airtax or HR Block two of our Uber Pro Rewards partners or the ATO directly if you have any further questions. The city and state where you drive for work.

Driving for Uber and Uber Eats. If you are leasing your car to drive for Uber you can deduct the relevant portion of the lease costs proportional. Whether youre in between jobs or needing to earn some extra cash in your spare time working as a food delivery partner is an exciting venture in the world of sole trading.

Just as with all other income-generating activities if you are a food delivery service provider there are tax. Uber Drivers Lyft drivers and other rideshare drivers. Order food online or in the Uber Eats app and support local restaurants.

The average number of hours you drive per week. First-time users Time to Read. According to our figures drivers in Australia have an average income of 3315 per hour before Uber takes.

Here are the 9 important concepts you need to know about taxes as an Uber Eats delivery contractor. Your Tax Summary document includes.

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Ato Simple Tax Calculator Clearance 50 Off Pwdnutrition Com

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Ato Simple Tax Calculator Clearance 50 Off Pwdnutrition Com

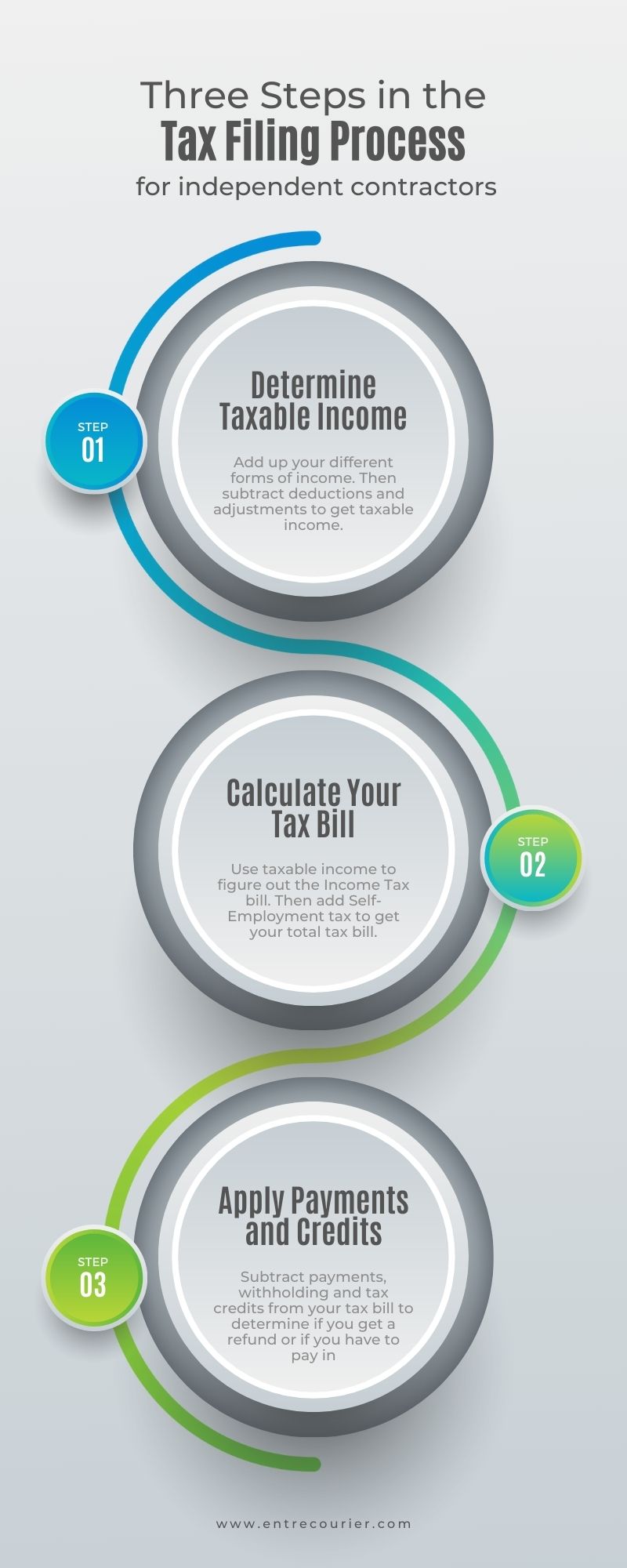

9 Concepts You Must Know To Understand Uber Eats Taxes Via Entrecourier Com In 2022 Understanding Uber Income Tax Return

Uber Eats And Other Delivery Drivers Here Are The Tax Deductions To Maximize Refund In 2021 Accurate Business Accounting Services Campsie Tax Returns 49

How To Do Your Taxes For Uber Eats Partners In Australia Youtube

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Tax Information For Driver Partners

Uber Gst Calculation In Australia Youtube

The Uber Lyft Driver S Guide To Taxes Bench Accounting

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Ato Simple Tax Calculator Clearance 50 Off Pwdnutrition Com

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Ato Simple Tax Calculator Clearance 50 Off Pwdnutrition Com

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Uber Tax Summary Information For Driver Partners Uber Uber Blog